Understanding FICO and Credit Score’s

(ThePennyWatcher) – Buying a house is the biggest investment you will dive into in your life. When deciding to do this, there are are specific ways in which lenders look at your standing when considering your buying ability.

These two factors are your FICO Score vs. Credit Score.

They both are important.

What is a FICO Score and a Credit Score – Explaining the Difference

FICO scores, which are the most used credit ratings out there, consider your repayment track record, what you owe on loans and cards, and how long you’ve been using credit. So think of all the credit cards you have, in addition to potential college loans.

If you have a solid re-payment history you should be in a good spot.

But your credit score is a bit different. It’s shaped by a bunch of factors, with your info from the top three credit bureaus playing a big part. While credit scores and FICO scores are similar in many ways, they can differ slightly in terms of the specific factors used to calculate them.

What Factors Affect Your FICO and Credit Scores

If you’re late on payments, skip them altogether, or have bills sent to collections, your credit score’s going to take a hit. Credit utilization ratio, the amount of credit you’re using compared to your credit limit, also plays a role. Keeping your utilization under 30% can maintain a healthy score.

Your credit score also gets influenced by how long you’ve had credit, the variety of credit types you have, and your recent applications for new credit. A bit complicated, but the good thing is there are two major companies out there that will do all of the dirty work for you.

They are TransUnion and Equifax.

While these are the two prominent companies, you can find free credit score elsewhere but if your really serious about it it’s probably worth paying the small fee to see what your “real” scores are.

TransUnion & Equifax

Both of these giants provide essentially the same thing, monitoring for your credit. You should get both scores, there really isn’t one that is looked at over the other. It will be good to have both in your back pocket when looking at large decisions like buying a house.

Here is a brief list of the services:

- Credit reports: Credit reports such as payment history, and late payments.

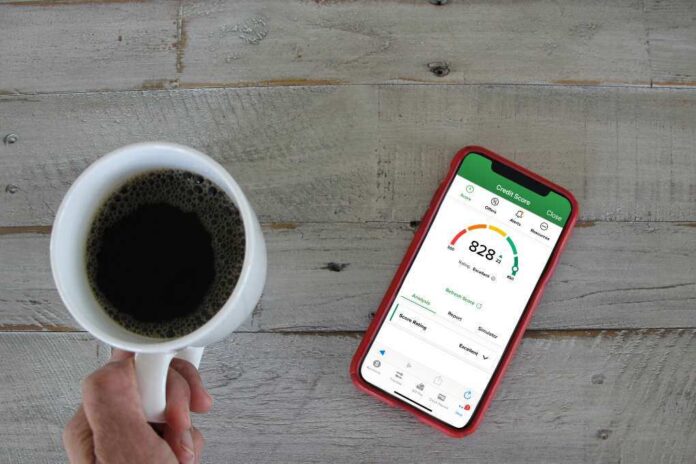

- Credit scores: Scores up to 820 being the best. You want to be somewhere 650 or above to be safe.

- Credit monitoring: Credit monitoring is good to have as you can be alerted when an odd charge is made, or if they have made a change to your score.

- Identity theft protection: We should all have some sort or monitoring. You never know when someone may gain access to your accounts.

FICO

Yes, the main score you want to see high scores in is FICO. Your FICO score can range anywhere from 300-850, and similar to credit score you want to be as high as you can. The higher your score, the lower the risk you are from the lenders perspective.

The folks at FICO look at a similar arrangement of payment history, overall existing credit, amounts owed, and types of credit. You can see how having a good grasp on all 3 of these sources is your secret weapon to get what you want.

So make sure your paying attention and being responsible with your money and credit, because when it comes time your going to need Mr. FICO in your corner!